The billion-dollar question: is the AI boom just getting started—or are we already watching it quietly unravel?

The Call That Shook Silicon Valley

A few years ago, I watched a friend lose a small fortune after he bet big on a “can’t-miss” tech stock—right before it cratered. His mistake wasn’t the stock itself. It was ignoring the warning signs. So when I read that Peter Thiel—the billionaire investor who backed Facebook, founded Palantir, and helped launch OpenAI—just dumped his entire $100 million stake in Nvidia, I felt a chill of déjà vu.

Nvidia is the undisputed darling of the AI revolution. Its chips power everything from ChatGPT to self-driving cars. So why would one of the most connected minds in tech walk away now?

Let’s dig in.

A Massive Sell-Off That’s Hard to Ignore

In November, Thiel’s hedge fund sold off its entire Nvidia position. Not just a portion—every last share. This wasn’t your average profit-taking move. Nvidia’s stock has more than doubled in the past year, fueled by surging AI demand. It’s signed major deals with OpenAI and other hyperscalers, and it’s central to every flashy “future of AI” headline.

So if the future’s so bright, why cash out?

Turns out, there are cracks forming beneath the glossy AI exterior.

The Cracks in the AI Gold Rush

While headlines tout trillion-dollar valuations, behind the scenes, AI companies are quietly running out of cash—and options.

- Equity funding is drying up. Startups used to raise money by selling shares. But with stock prices falling and VC appetite cooling, that lifeline is vanishing.

- Debt is the new crutch. Tech giants like Amazon, Meta, and Microsoft have issued over $100 billion in bonds in just the last few months to fund their AI ambitions.

- AI isn’t profitable yet. Many generative AI tools still don’t bring in enough revenue to justify their staggering infrastructure costs.

As OpenAI itself seeks debt to support its $1 trillion plans, it’s clear the old financial engines are sputtering.

So, What’s the Risk?

Here’s the rub: Nvidia’s revenue depends on these same companies being able to afford its chips. If Big Tech tightens its wallet, or if credit becomes too costly, Nvidia’s projected future growth could collapse. As Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.”

Thiel likely saw the tide receding early.

Stock Market on Thin Ice

AI stocks have driven 75% of the S&P 500’s gains this year. That kind of concentration is risky. One major disappointment—like a missed Nvidia earnings report—could ripple across the market. And when the S&P dipped below its 50-day moving average in November, it was mostly due to losses from AI hyperscalers.

The AI bubble may not burst overnight—but signs point to a slow, painful deflation.

Key Takeaways:

- Thiel’s sell-off signals caution, not hype.

- AI companies are increasingly reliant on debt.

- Nvidia’s value is tied to fragile funding cycles.

- The AI industry is outpacing profitability.

- Markets are fragile, and concentration is risky.

Expert Insight:

“The true cost of AI isn’t just in the chips—it’s in the promises made to investors about tomorrow’s tech that today’s revenue can’t fulfill.” — Benedict Evans, former VC & tech analyst

Final Thought: Watch the Builders, Not the Buzz

Peter Thiel didn’t sell Nvidia because he doesn’t believe in AI. He sold because he knows a financial correction is coming. The tech is still revolutionary—but revolutions don’t pay bills.

If you’re investing in AI, focus on companies solving real problems with sustainable revenue—not just flashy demos.

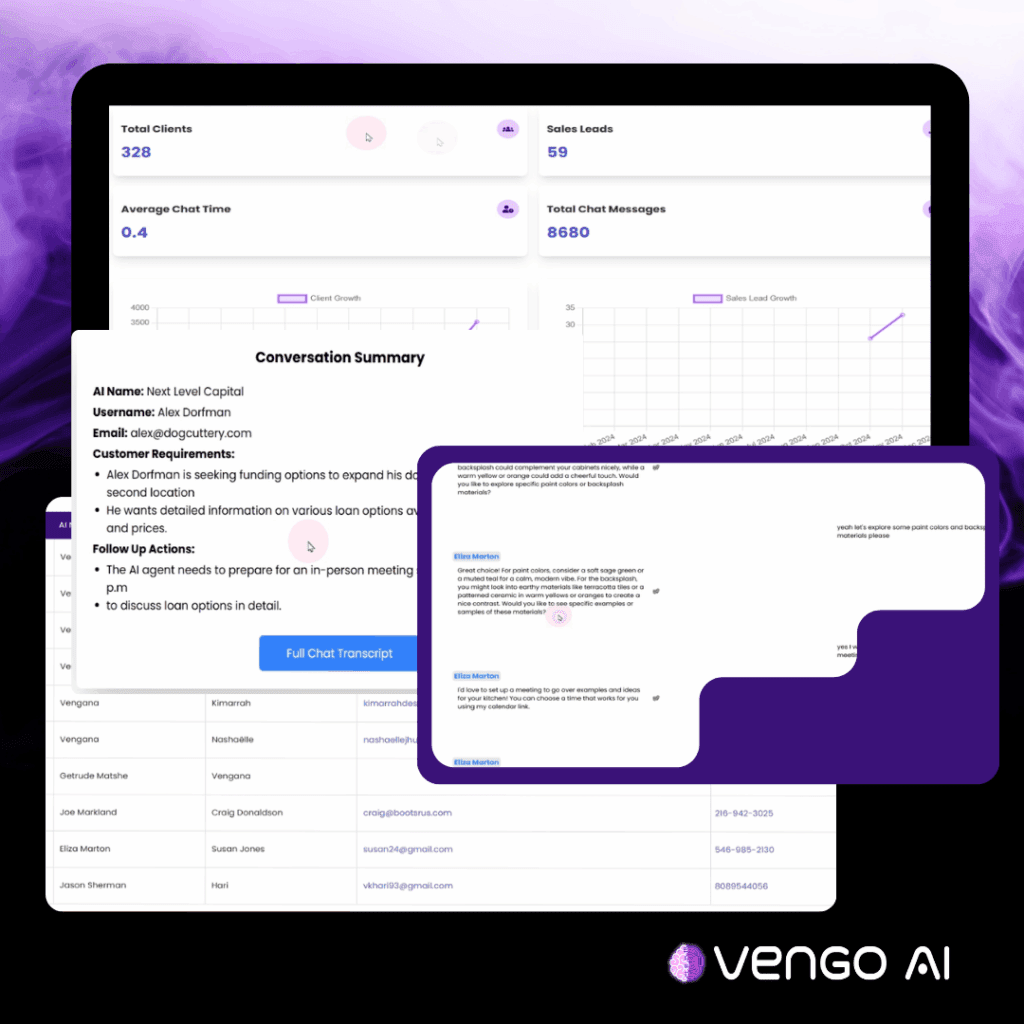

Want to see what real ROI-driven AI looks like? Start with how Vengo AI is helping small businesses use AI to close sales today—not ten years from now.